The sooner investments are made, the more profound their results will be, and if you are living in the United Kingdom and not taking advantage of its welcoming investment opportunities to put your money to work for you, you’re missing out. Don’t postpone it.

This article provides concise, practical, straight to point suggestions on how to kick start your investment journey.

Disclaimer

- I am not a qualified licensed investment advisor. The contents in this article are not financial advice.

- I will not and cannot be held liable for any actions you take as a result of anything you read here.

- Always do your own research and seek independent financial advice when required.

- When investing, your capital is at risk. Investments can rise and fall and you may get back less than you invested. Past performance is no guarantee of future results. Other fees may apply.

Foundation

Why

Growing wealth has been vilified and correlated with the unscrupulous and greedy. Far from that, money is more than a number and currency: it provides options. The option to say no to that task / job you don’t want to do; options to provide for your family and close ones; options to give back to society and the world; options to support your health, well being and comfort. There is nothing wrong with that.

So why would you consider investing your hard earned money? Why do it as early as possible?

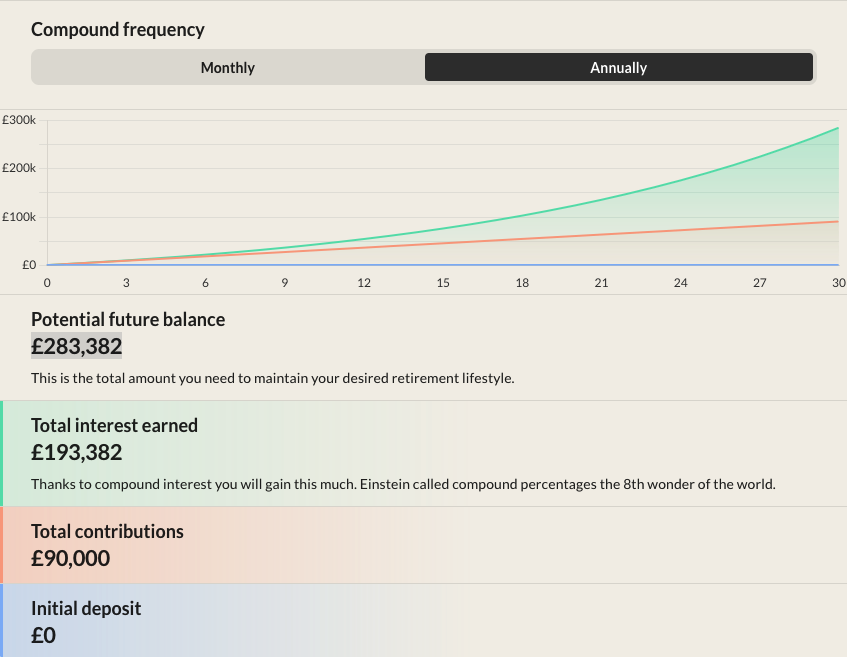

Let’s say you are 20 years old, and have zero net worth. No money in the bank, no assets. After that point, every month, for the next 30 years, you invest £250 every month (roughly equating to £8.4 per day). Let’s assume that investment yields a yearly 7% return on investment every year, on average (which is viable assumption, considering the SP500 historical performance). By 50 years old, this would be the result:

- Contributions: £90,000 (250 * 12 * 30)

- Interest earned: £193,382 (thanks to compound interest you will gain this much. Einstein called compound percentages the 8th wonder of the world)

- Total: £283,382

Imagine how much higher these values could get if the invested values are increased. You can use this calculator to have an idea.

Long term game

Forget about get rich quick schemes. Going down that path would be comparable to buying lottery ticket and wish for a winning prize, but the odds of getting struck by lightning are nearly 20,000 times higher than hitting the winning numbers for the next Powerball jackpot.

Building wealth is a long term game which requires discipline, structure and time.

Methodology

Create an emergency fund

Make sure you have the equivalent of about 6 liquid months worth of your income available. Life is unpredictable, so make sure you have a reachable safety net which you can rely on and use promptly.

Pay off your (consumer) debts

Compound investment works both ways: the more you invest, the more your wealth “snowball” will pick up along the way, growing exponentially. On the other hand, if you have debts that require you to pay interest, the inverse applies, progressively eating into your wealth.

As such, gather all your debts, order them by their interest rate, and make sure to pay the ones with the highest interest rate first. Prioritize non-equity based debts, such as credit card debts. Mortgages are equity based, so a portion of your payments goes towards your equity, so they would have less priority compared with pure consumer debt, but make sure they will not overburden you.

Budget

Budgeting doesn’t mean living in extreme frugalness. Budgeting is about knowing what you need and want, and how much of your income would you be willing to allocate to them. Budgeting makes it easier to reason about your expenses, and having control over them, rather than them controlling you.

Make it as simple or complicated as you would want. You can start by putting in a sheet your monthly income, and subtract from it your fixed (e.g. rent, mortgage, internet bill) and variable expenses (e.g. entertainment, electricity bill, travel). In the end, the objective is that you have a better grasp of how much comes in / goes out. This will inform you on how much disposable income you will have available towards investments.

Automate

Unless you are a professional trader, you don’t want to spend the entirety of your (limited) time and energy maintaining your investments. If so, that becomes a chore / job by itself. The whole point is to make money work for you, not the contrary.

So automate everything as much as possible. What you can’t automate, make it into a well defined process that requires minimal effort.

I suggested you review / maintain your investments only once per month, every month. If you are an employee, make this shortly after your paycheck comes in.

Systematize. Know where your assets are. Visit them.

- Every month, invest as much as possible from your income (this amount would be informed by your budget, and your risk appetite). You can also automate this process by scheduling a periodic amount from your bank account into your investment platform. I don’t particularly like this full automation strategy, since I prefer to adapt my investment amount to what I predict my spending will be on the following month, allowing for a tighter / more aggressive investment strategy. I personally prefer to have as little uninvested money as possible. YMMV.

- Make a spreadsheet. Doesn’t need to be fancy, just functional. It will only be used by you (in principle), so organize in however way you think it is best. Personally, I have different pages for each bank, trading platform, p2p platform, etc. Each of these pages has an history of the current invested amount in these platform, per month. Then an extra page summarizing / summing up all of these assets, with some optional graphs. Having this visual historical summary of all your assets in a single place is gratifying. Seeing how far you came on your investment journey, explicit in a graph, is incredibly fulfilling and powerful.

- Update this spreadsheet periodically, and re-balance your assets as needed. I recommend every month, right after you receive your salary. There are ways to do it automatically, but taking this time to go through all your assets provides visibility on any gaps and strategy changes that need to be done. Personally, this takes me one hour. That’s how long it takes to perform maintenance on my investments: 1 hour every month, that’s it.

Diversify. Adapt to your situation

Having your investments diversified across different baskets allows you to balance your risks are diffuse your liabilities across different spaces, which ultimately protects you.

The strategy you would want to adopt for your investments in your 20s, likely won’t be the same as the strategy in your 60s. For example, later on in life, you might want to invest in safer investment vehicles, such as UK Government bonds (essentially, the country would need to go bankrupt for you to lose your money), savings accounts, cash ISAs and real estate.

Investment Vehicles

With our foundations in place, it’s time to dive into the nuts and bolts.

Max out your workplace pension

Usually, if your are employed, your employer will make regular payments into your pension pot on your behalf. And, depending on the plan you belong to, you may also make monthly contributions which will be taken from your salary. Some employers increase their contributions if you increase the monthly amount you put aside as well. This tends to be a direct match – if you put aside an extra 1%, they add an extra 1%, but there will be a maximum level they will match.

There are two allowances you should keep in mind:

- Your annual allowance is the maximum level of total pension contributions to all of your pensions (made by yourself, your employer(s) or anyone else) that will receive tax relief in a tax year. It is currently £60,000, although could be lower if you have an adjusted income over £240,000 or you have already made a taxable withdrawal from any of your pension plans.

- The lump sum allowance (LSA) is the maximum amount of tax-free cash you can take from your pension savings in your lifetime. You can take 25% of your pot tax-free, as long as this amount is not higher than the LSA.

Own the World: Stocks, ETFs

Google, Apple, Tesla, NVIDIA: what if you could own a part of them and profit from their earnings by receiving dividends from them and / or getting capital gains from their (hopefully) raising share prices?

Turns out, you can. Either by buying their individual stocks, or better yet, you can invest on a index fund, such as the S&P 500.

S&P 500

S&P 500 contains the top 500 U.S.A. publicly traded companies with a primary emphasis on market capitalization. Most interestingly, this list isn’t manually curated by a human or an opaque heuristic. The list is based on the market capitalization only, and it is considered one of the best gauges of large U.S. stocks and even the entire equities market because of its depth and diversity. This dilutes the risk you are exposed to, and historically has provided a realistic yearly ~7.5% return on investment.

You can’t invest directly in the S&P 500 because it’s an index but you can invest in one of the many funds that use it as a benchmark and track its composition and performance.

To make it easier, you can get a S&P 500 Exchange-traded fund (ETF). ETFs and index funds are similar in many ways but ETFs are considered to be more convenient to enter or exit. They can be traded more easily than index funds and traditional mutual funds, similar to how common stocks are traded on a stock exchange.

Here are two S&P 500 ETFs, which have a low maintenance cost:

- S&P 500 UCITS ETF - Distributing (VUSA): the dividends are paid out to you, and you can choose to reinvest them, invest them elsewhere, or just cash them out.

- S&P 500 UCITS ETF - Accumulating (VUAG): the dividends are automatically reinvested into the ETF, which makes the process more automatic, in case you want to reinvest your earnings (which likely, you should). Note that, even though these dividends are reinvested directly into the ETF, they are still considered as earnings by the HMRC, so in the tax perspective, there is no difference between distributing and accumulating.

Other ETFs

Investing on a S&P 500 is already a significant step up from plain low interest savings accounts, but you would be overly exposed to the U.S.A. market. As such, you can consider ETFs which further diversify your exposure, such as the FTSE All-World UCITS ETF - (USD) Accumulating (VWRP), which is comprised of large and mid-sized company stocks in developed and emerging markets.

The above ETFs are provided by Vanguard (which tends to have low maintenance costs for their ETFs), and can be bought in several trading platforms, but there are many other reputable companies providing similar ETF, such as BlackRock.

Where to buy these Stocks and ETFs

- justetf: is a great website to explore and get details on costs and performance of an ETF you are aiming to invest in

- Vanguard: if you are starting out on your ETF investment journey, I strongly suggest this platform to invest in your ETFs. Making deposits and managing investments is straightforward and has the right amount of information and process, in order to not be overwhelming

- Interactive Brokers: this platform has been around for a long time, is low cost, well-capitalized, provides for very low cost exchange rates, and allows you to invest in a large amount of available stocks and ETFs. The trade-off is that it takes longer to onboard, due to its interface complexity and wide range of tools and information.

- Trading212: commission-free platform that doesn’t apply any commission on trades, but does charge 0.15% on currency conversion fees. Make sure to take these hidden costs into account.

Vanguard, Interactive Brokers and Trading 212 are regulated in the UK by the FCA. I recommend you spread out your investments in different platforms, in order to reduce the risk / hassle in case any of them is shut down or rendered illiquid.

ISA

Every time you sell the above ETFs or Stocks at a gain (for example, you bought £100 worth of an ETF, and then sold it for £150), and every time dividends are received (regardless if they are paid directly to you, or reinvested), you will need to pay taxes on them, unless you are still within their respective allowance. 1

One way to not pay any of these taxes2, is to use a stocks and shares ISA. The stocks and shares ISA is one of the types of ISA. Other ones being cash ISA (type of savings account that offers tax-free interest), innovative finance ISA (peer to peer lending with tax-free interest) and Lifetime ISA (tax-free savings account that gives a 25% bonus if used for retirement or to buy a first home).

As of the time of this writing, the maximum yearly amount allowed to be saved via ISAs is £20,000. This means that across any of the above 4 types of ISAs you can only deposit in them up to £20,000. You can withdraw them at any point in time. 3

Some specifics on this:

- Creating a Stocks and Shares ISA is fairly straightforward. The above brokers (Vanguard, Interactive Brokers and Trading212), all allow for you to create a Stocks and Shares ISA account. This account is exactly the same as a normal / general account, except that it is tax sheltered. The ISA account would be separate from a general investment account you might want to create, in case you already reached your £20,000 limit, and want to continue investing (which I recommend).

- You can create ISA accounts in multiple providers of any types you choose, but remember there is a global £20,000 limit. For example, if you have a Cash ISA on HSBC where you deposited £15,000, and Stocks and Shares ISA on Vanguard, you can only deposit up to £5,000 in Vanguard’s Stocks and Shares ISA account. You can transfer your ISA account across providers, to avoid losing your tax free investments.

- If you deposit £18,000 on a ISA account and then withdraw all of it, you will only be able to deposit £2,000 on a ISA account after that (on the same tax year4)

- Every year, the annual ISA allowance will renew, and your investments from the previous year(s) will still have tax free gains. As such, avoid at all possible costs to withdraw your investments for these ISA accounts. Even if your ISA investment was made several years ago, their gains will still be tax free.

- Any capital gains and dividend gains yielded from your investments made in an ISA account will be tax free.

Cashback

You can earn, while consuming. That is cashback.

The reason why this is possible in the first place, is because products are originally sold at a higher margin price, and cashback mechanisms are essentially a way to clawback part of that extra margin back to you. There are essentially two ways you can claim this: via credit cards (and bank accounts), cashback reward websites.

Credit cards (and bank accounts)

There are several credit cards and bank accounts that allow you to gain cashback. Usually you can expect a 1% cashback rate, save from their respective promotional periods.

- American Express (Amex) cards are overall the best when it comes to cashback rewards, such as the zero-fee Amex Cashback Everyday Credit Card. Trade-off being that not every establishment accepts Amex cards, so you will need a fall back.

- Since Amex cards are not accepted on all establishments, it is a good idea to have a backup Mastercard or Visa card, which are widely accepted. Have a browse through these top cashback cards to have an idea of what is available.

- There are credit cards which have pre-conditions, such as having minimum spend, an associated bank account, maintenance fee, amongst others, so make sure to take these into consideration to calculate your bottom-line

- There are credit cards which collect Avios instead, such as the British Airways American Express® Credit Card. Unless you plan to use them for travel, use their respective perks (e.g. lounge passes), and have spendings that are leveraged by these points, I would steer away from them. This is because there is an associated monetary value with each of these points, and personally I prefer to have these saving readily available on cash.

- Remember to pay your credit card spending every month in full, otherwise you will be hit by the gargantuan interest rates (about 30%).

Cashback reward sites

On top of the above credit card cashback rewards, you can clawback another layer of cashbacks via rewards sites. In the United Kingdom, the #1 site is TopCashback. To leverage it, just quickly search on their website if they offer rewards for a purchase you are about to make (e.g. hotel booking via Expedia, which easily gets you 10% cashback), use their link, and once you complete the purchase the reward will be available in a few weeks. This is incredibly powerful.

You can leverage other reward sites, such as the perks provided via Amex, that need to be activated, but personally, I wouldn’t bother too much with them.

Points / loyalty cards

Another level on top of the above cashback methods, is to use points cards on for your favorite merchants / supermarkets, which can either provide you direct discounts, or accrue points that can be exchanged later on by discounts or perks. In general they are quick to set up, and their respective cards can be added to virtual wallets, so there is no need to carry their physical presence. For example:

- Nectar Card: useful for Sainsbury’s purchases

- Waitrose Membership

- Tesco Clubcard

Watch / Phone Wallet

With all of the above credit and points cards, a wieldy and secure way to have them at hand is to add them to your watch or phone. Google and Apple devices largely support these wallets, and adding them is overall straightforward. One aspect I particularly like about this approach, is that carrying around credit cards using wallet appears feels more secure than carrying a physical card, which if stolen, the mechanisms available to block are mostly leveraged via the card provider, whereas via a virtual wallet, apart from have the card’s access walled by the device’s default access (e.g. pin code), the device can also be remotely wiped, if needed.

Equity investments

Seed investment on companies (such as startups) is not restricted to angel investors and VCs. These investments are now widely available via crowdfunding platforms such as Crowdcube or Seedrs / Republic:

- These platforms allow you to contribute towards a round of investment in a given company.

- This is a high risk, high reward / loss business proposition, since there are only very specific conditions in which you can withdraw your investment (e.g. company is acquired, gets IPOed). There is a high likelihood that these companies either take a long time span to exit, or that they will go bankrupt.

- Many of these are covered by a tax relief, such as Enterprise Investment Scheme (EIS), meaning that you can deduce a percentage of your investment from your taxes. For example, if you invest £100 of a company under the EIS scheme, you will be able to deduce £30 (30% of £100) from your taxes (if you do not expect to pay that amount of taxes, then this would not be useful for you).

- Commonly there are associated perks provided by the companies, such as redeemable vouchers on their businesses.

Other vehicles

Other investment vehicles you can consider are real estate (e.g. buy to let, REIT), commodity trading (e.g. silver, gold), forex trading (buying one currency and selling another while attempting to profit from the trade), crypto trading, p2p lending. Even though I have some experience with some of them, these are not my main focus of my investment strategy, so I’ll abstain from making many remarks on them.

Final thoughts

The above guide is not extensive, by all means, and there are thousands of ways to put your money to work effectively, but it is important to not go overboard and over optimize, as too much time spent on these will eventually carve away from other meaningful areas of your life, such as overly obsessing over points optimizations. This is an eventual opportunity cost, and you should be aware that these methods are a means, not the end. Optimize just enough, automate as much as possible, reap the rewards, gain options, and enjoy your life to fullest!

-

Dividend gains allowances, and capital gains allowances.↩

-

ISA is a tax avoidance mechanism encouraged by the UK government. Tax avoidance is related to avoiding taxes using mechanisms that are legal and are expected to be used. Tax evasion, on the other hand, is the usage of illegal methods to circumvent and evade taxes.↩

-

Stocks and Shares ISA is very similar to its USA counterpart, the Roth IRA, which has a $6.5k yearly limit, and its withdrawal can only be made at age 59.5 tax free.↩

-

A UK tax year runs from 6 April to the following 5 April.↩